Category

FINANCIAL SERVICES

Date

12/2023

How loyal are your customers, and do they feel they are treated fairly for choosing your bank? Customers naturally gravitate towards banks that not only acknowledge, but also reward their loyalty. It is a core customer expectation that banks must deliver benefits and services. However, it’s noteworthy that despite numerous banks professing a focus on customer care, less than 20% extend rewards encompassing the entirety of the customer-bank relationship.

According to McKinsey’s Global Banking Annual Review 2023, there has been a significant divergence in value creation among different types of financial institutions. Payment providers and investment banks have seen increases in their earnings per share and overall value creation compared to other financial institutions like global systematically important banks and universal banks. This trend highlights the changing landscape of the financial sector and the increasing importance of innovation and adaptation to customer needs.

How do you identify effective strategies to navigate this evolving landscape and capitalize on the market opportunities for loyalty services in 2024?

Navigating the Digital Shift: Fintech Giants Transform Loyalty in Banking

In the rapidly changing world of modern banking, traditional loyalty services are becoming less relevant as digital consumers demand more dynamic offerings. Banks need to adapt by adopting strategies that align with the expectations of today’s discerning customers.

Revolut is leading the way in loyalty programs with its user-centric features. The program offers exclusive discounts at restaurants and retailers, instant cashback on various purchases, and a notable 10% cashback on gift cards purchased through the Revolut app. This approach not only simplifies the user experience but also significantly enhances customer engagement.

Comparatively, Bank of America’s ‘Preferred Rewards’ program offers a unique benefit with its 5% interest rate booster, enriching the banking experience for its customers. Meanwhile, JPMorgan’s ‘One Card’ leverages a points-based system without expiration, providing flexibility in redeeming points for cash credit or merchandise. This flexibility particularly appeals to businesses looking to reinvest points or reward employees, adding a compelling dimension to their loyalty offerings.

These examples highlight the diverse strategies banks are employing to meet the evolving needs of their customers, showcasing the innovation and adaptability required in today’s banking landscape.

Market Landscape and Opportunities

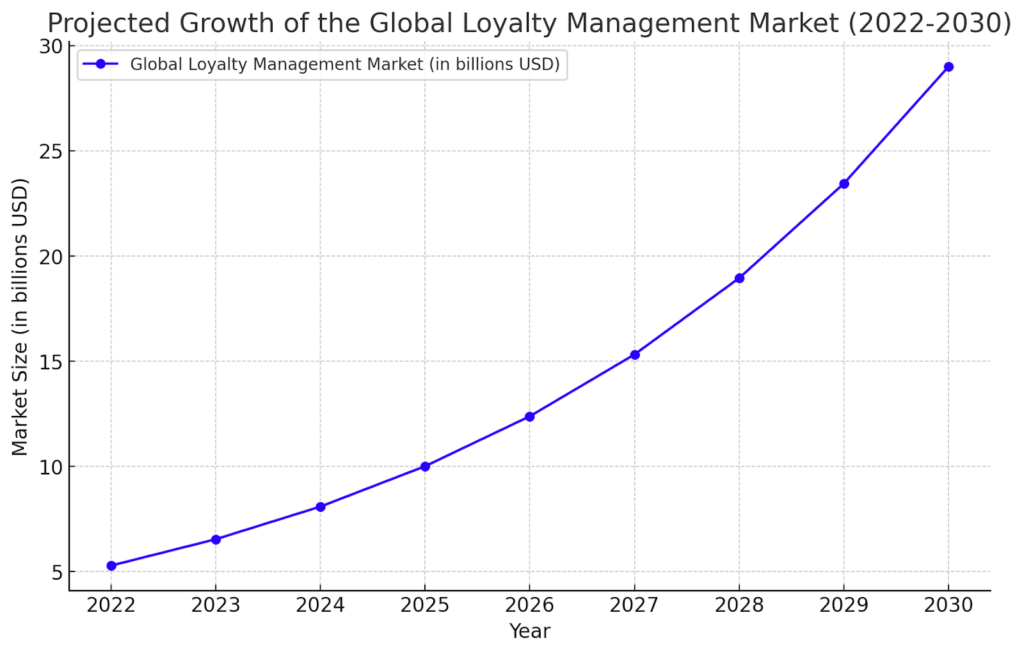

Valued at approximately US$5.29 billion in 2022, the global loyalty management market, including loyalty services in banking, is projected to witness substantial growth. By 2030, the market is expected to escalate to around US$28.65 billion, propelled by a robust Compound Annual Growth Rate (CAGR) of 23.7% from 2023 onwards. Key regions driving this growth include North America, due to a strong preference for monetary incentives and advanced loyalty solutions, and Asia Pacific, bolstered by an increasing focus on enhancing customer experience and the burgeoning e-commerce sector.

In terms of deployment models, over 50% of the market share in 2022 was attributed to on-premise solutions, preferred for their robust data security and customization features. Meanwhile, cloud-based solutions are anticipated to grow at a CAGR of 10.4%, offering advantages such as lower maintenance costs and efficient remote management capabilities.

Specifically, for the retail bank loyalty program segment, the market size stood at approximately US$1.105 billion in 2022. It is expected to grow at a CAGR of 7.96%, reaching about US$1.75 billion by 2028. This trend underscores the growing emphasis and investment in loyalty programs within the banking sector, reflecting the broader market movement towards personalized, technology-driven customer engagement solutions.

Overall, these insights highlight a dynamic and rapidly expanding market for loyalty services in the banking industry, forming part of a larger trend towards more personalized, technology-driven customer engagement and loyalty programs across various sectors.

What Are Crucial Customer Needs for Successful Financial Loyalty Programs?

- Mobile Wallet for Loyalty Card Management:Recent studies indicate that 55% of customers prefer managing their loyalty programs through a mobile wallet, yet only a mere 17% of financial providers currently offer this feature. To bridge this gap, there’s a pressing need to develop an intuitive wallet app that digitizes loyalty card management, thereby phasing out the cumbersome physical cards. This innovation not only aligns with customer preferences, but also significantly streamlines the loyalty process, enhancing overall user satisfaction.

- Savings with a Loyalty: Shop Smart, Earn Smarter. Integrating your loyalty program with a wide array of popular merchants and businesses can substantially elevate its value. Customers greatly appreciate earning rewards and benefits not just through banking activities, but also while shopping at partnered merchants. Such integration magnifies the loyalty program’s appeal and utility, fostering increased customer participation and deepening their engagement with your banking services.

- Personalization for Improved Engagement: Personalized offers resonate more effectively with customers. By weaving personalization into your loyalty programs, you create a more meaningful and relevant connection. Tailoring rewards to align with customers’ regular transaction patterns or preferred locations can significantly boost engagement. This strategic move not only elevates customer experience but also solidifies their preference for your banking services, fostering a sense of loyalty that goes beyond transactions.

How to Succeed in the Market for Loyalty Service for the Banks in 2024

Wondering how to navigate the right approach to loyalty services? Whether you’re exploring the right solutions for your business, aiming to digitalize an existing loyalty program, or simply eager to stand out from your competitors, we’ve got you covered. In a brief 15-30 minute consultation, our experts can help you find the answers you need and guide you towards the right direction in your loyalty journey. Contact us at [email protected] to schedule a meeting and unlock the potential of our proven loyalty solutions.